Well Link Investment Research | July 28th: Panic Selling May End, Seek Rebound and Pay Attention to the Following Points!

2024-07-29

The following article is sourced from: Hong Kong Soros (Pseudonym)

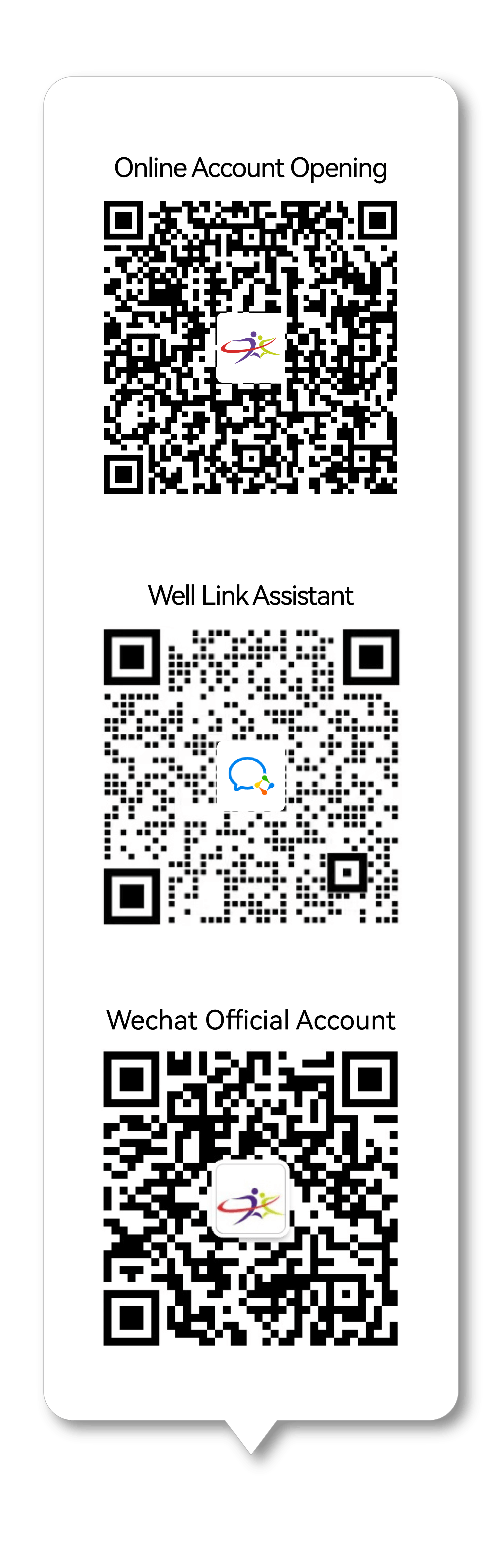

Edited by: Well Link International Securities

SPX overview

Technical: The S&P 500 (SPX) and Nasdaq (NDX) weak rebound their sell-off, which was caused by carry trade unwind and fears on US election uncertainty spiked as Biden is not running.

Sentiment: Fear to Neutral.

Market Breadth: Neutral.

Macro: Most asset class rebound from sold off.

Market scenario outlook :

Most carry trade unwind flows and fears should be largely priced in. Market should re-focus on Fed and US economic data. Therefore expect trading range start to narrow,

so a range trading environment could be expected, unless unexpected Fed actions or surprising economic data.

Stocks :

Short-term volatility plays:

Investors seeking to capitalize on short-term volatility spikes could consider selling put options on the SPX or NDX or using leveraged inverse ETFs like TQQQ or SPXL with caution due to their aggressive risk profile